How to reduce expenses and save money. Welcome to our blog post on how to reduce expenses and save money! In today’s fast-paced world, keeping a tight hold on your finances can be challenging. But fear not because we’re here to help you take control of your spending and turn those pennies into pounds!

Whether you’re saving up for a dream vacation, paying off debts, or simply looking for ways to build up an emergency fund, the key lies in understanding where your money is going and finding ways to cut unnecessary expenses. By following some simple strategies and implementing smart financial practices, you can start building a solid foundation for a brighter financial future.

So grab your coffee (or tea!) and get ready to dive into the world of frugality and budgeting. Let’s explore some practical tips that will empower you with the knowledge and tools necessary to achieve both short-term savings goals and long-term financial stability.

Are you ready? Let’s get started by identifying your expenses!

Identifying your Expenses

When it comes to reducing expenses and saving money, the first step is identifying where your money is going. Many of us have a vague idea of our monthly expenses, but without a clear picture, it can be difficult to make meaningful changes.

Start by gathering your financial documents – bank statements, credit card bills, receipts – anything that will give you insight into where your money is being spent. Next, categorize these expenses into different groups: housing, transportation, food, entertainment, etc.

Once you have categorized your expenses, closely examine each category. Are there any areas where you are spending more than necessary? Are there any recurring charges or subscriptions that you could do without? Sometimes, we overlook small expenses that add up over time.

It’s also essential to consider variable expenses such as dining out or impulsive shopping trips. These can often be the biggest drains on our wallets if left unchecked. By identifying these habits and patterns in our spending behavior, we can begin to make adjustments and find ways to save.

Remember that this process may require self-reflection and honesty about our spending habits. It’s not always easy to confront areas where we may be overspending or making unnecessary purchases. However, by taking the time to identify our expenses accurately and honestly evaluate them, we empower ourselves with the knowledge needed to make positive changes for better financial health.

So grab coffee (or tea) and set aside some dedicated time for this exercise. You might be surprised at what you discover!

Creating a Budget Plan

One of the most important steps in reducing expenses and saving money is to create a budget plan. This allows you to clearly understand your income, expenses, and financial goals.

Start by identifying all your sources of income, including your salary, freelance work, or any additional revenue streams. Next, list all your recurring monthly expenses, such as rent or mortgage payments, utility bills, transportation costs, groceries, and other necessary expenditures.

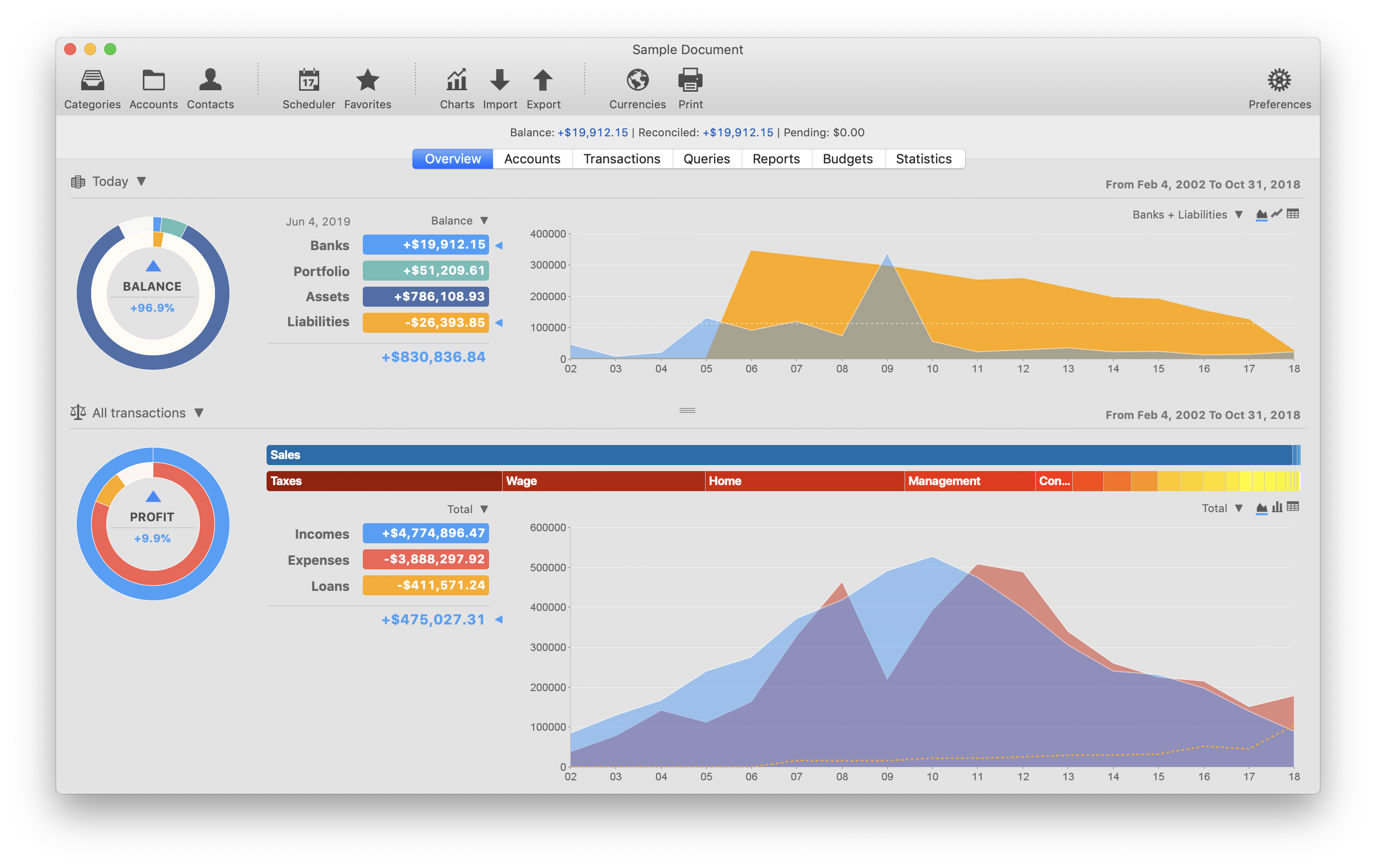

Once you have these figures laid out on paper or using personal finance software like iCash (which offers helpful charts for budgeting), it’s time to analyze where you can make adjustments. Look for areas where you can cut back or reduce spending.

In iCash, the overview panel second chart at the bottom shows incomes in blue and expenses in red. You can easily see if you are saving money (blue with no red background) or overspending (red with no blue background).

Consider if there are any unnecessary subscriptions or memberships that can be canceled. Evaluate your grocery shopping habits and see if there are ways to save money by buying generic brands or planning meals ahead of time.

Additionally, negotiating lower bills and rates with service providers can also help free up some extra cash each month. Call your internet provider, cable company, or insurance agent, and ask them about discounts, special promotions, or loyalty programs.

Finding alternative ways to save money is another smart approach.

One example could be switching from eating out at restaurants regularly to cooking at home more often.

This not only saves money but also allows for healthier meal options.

You could also explore thrift stores instead of always going for brand-new items when shopping for clothes.

There are countless creative ways to cut costs once you start thinking outside the box!

In conclusion, having a well-thought-out budget plan is essential.

It helps track income and expenses while identifying areas where reductions can be made.

Combined with strategies like negotiating lower bills and finding alternative ways to save, you’ll soon find yourself progressing toward achieving financial stability.

Start now, and take control of your finances!

Cutting Down on Unnecessary Expenses

When it comes to saving money, one of the most effective strategies is cutting down on unnecessary expenses. It’s easy to get caught up in a cycle of impulse buying and overspending, but with discipline and planning, you can significantly reduce your expenses and boost your savings.

One way to start is by examining your spending habits and identifying areas where you’re consistently overspending. Look closely at your bank statements and credit card bills to see where your money goes. Are there any recurring subscriptions or memberships that you no longer use? Cancel them! Do you find yourself eating out often? Consider cooking at home more frequently.

Another great way to cut down on unnecessary expenses is by creating a shopping list before heading to the store. Stick to this list religiously and avoid making impulse purchases. You’ll be surprised how much money you can save by resisting the urge for those extra items that catch your eye.

Additionally, consider finding cheaper alternatives for everyday items. Compare prices at different grocery stores or online retailers before making a purchase. Look for sales or discounts on items you regularly buy – sometimes, waiting for the right moment can lead to significant savings.

Try negotiating lower rates or bills with service providers such as cable companies or insurance companies if possible. They are often willing to work with customers looking for ways to save money. A simple phone call could result in substantial monthly savings.

Don’t underestimate the power of tiny changes in daily life that can add up over time. Cut back on expensive coffee shop visits by brewing your coffee at home. Bring lunch from home instead of eating out every day at work – not only will it save money and potentially promote healthier eating habits!

Money-Saving Tips for Everyday Life

When saving money, even small changes in your daily routine can add up over time. Here are some practical and easy-to-implement tips that can help you cut down on expenses and boost your savings:

1. Cook at home: Eating out frequently can affect your wallet. By preparing meals at home, not only do you save money, but you also have control over the ingredients and portion sizes.

2. Use public transportation or carpool: Transportation costs can quickly affect your budget. Consider using public transportation or carpooling with colleagues or neighbors to save on fuel expenses.

3. Shop smartly: Before purchasing, compare prices online or visit different stores to find the best deals. Additionally, make use of coupons and loyalty programs to maximize savings.

4. Cut back on subscriptions: Evaluate all your subscriptions (e.g., streaming services, memberships) and determine which ones are essential versus those that could be canceled or paused.

5. Reduce energy consumption: Lowering your electricity usage not only helps the environment but also significantly reduces your utility bills. Turn off lights when leaving a room, unplug electronic devices when not in use, and consider investing in energy-efficient appliances.

6. Trim unnecessary expenses: Take a close look at your monthly expenses and identify areas where you tend to overspend unnecessarily – such as impulse purchases or luxury items that aren’t necessary for everyday life – and adjust accordingly.

Remember that saving money doesn’t mean depriving yourself completely; it is about making conscious choices and finding alternatives that align with your financial goals and lifestyle preferences! Remember these tips as you navigate through everyday life while working towards building a solid financial future.

Negotiating Lower Bills and Rates

Negotiating lower bills and rates is an effective way to reduce your expenses and save money. Many people don’t realize they can negotiate with service providers, such as cable companies, internet providers, insurance companies, and even credit card companies.

Start by researching the current market rates for the services you’re using. This will give you a better understanding of reasonable and competitive prices. With this knowledge, contact your service providers and politely inquire about discounts or promotions.

Don’t be afraid to ask for a better deal or to switch to a different provider if necessary. Service providers often value their customers’ loyalty and may be willing to offer incentives to keep your business.

It’s important to remain polite but firm when negotiating lower bills or rates. Communicate your desire for a more affordable option while emphasizing the value you bring as a customer.

Remember that negotiation is all about finding common ground. Be open to compromises that benefit both parties involved. For example, you could agree on reduced fees in exchange for signing up for automatic bill payment.

By taking the time to negotiate lower bills and rates, you can potentially save hundreds of dollars each year. It may require effort, but the financial benefits make it well worth it!

Finding Alternative Ways to Save Money

Finding alternative ways to save money is a great way to boost your savings and reduce expenses. You can implement numerous creative strategies in your everyday life that will not only help you cut costs but also make saving money more enjoyable.

One effective way to save money is by adopting a do-it-yourself (DIY) mindset. Instead of hiring professionals or buying expensive products, try tackling specific tasks yourself. For example, instead of going out for dinner, cook meals at home using fresh ingredients from the local market. This saves money and allows you to control what goes into your food.

Another way to save money is exploring thrift stores and online marketplaces for secondhand items. You’ll be surprised at the quality and affordability of many pre-owned goods, such as furniture, clothing, books, and electronics. Not only does this approach reduce waste and encourage sustainability, but it also helps you stretch your budget further.

Consider implementing energy-saving practices in your home as well. Simple changes like switching off lights when not in use or adjusting the thermostat can significantly lower utility bills. Additionally, investing in energy-efficient appliances can provide long-term savings on electricity consumption.

Regarding entertainment and leisure activities, think outside the box for cost-effective alternatives. Instead of going to movies or concerts regularly, consider hosting movie nights with friends where everyone brings their favorite films or organizing game nights with board games you already own.

Furthermore, take advantage of free community events like park concerts or art exhibitions at local galleries. These options allow you to engage with culture without spending large sums on tickets.

Finding alternative transportation methods can also help trim expenses significantly. Consider biking or walking short distances instead of relying solely on cars or public transportation systems that require ticket fees or fuel costs.

By embracing these alternative approaches towards saving money daily, you’ll find that small changes add up over time and contribute positively towards your financial goals. So, start exploring these options today and enjoy the benefits.

Conclusion: The Importance of Saving and Financial Planning

In a world where financial stability is crucial, it’s essential to prioritize saving and financial planning. You can secure your future and achieve your goals by reducing expenses and implementing innovative money-saving strategies.

Saving money allows you to build an emergency fund, which acts as a safety net during unexpected medical emergencies or job loss. It also provides investment opportunities to generate passive income and help you grow your wealth.

Financial planning goes hand in hand with saving. You gain better control over your finances by creating a budget plan and tracking your expenses using tools like iCash personal finance software. You can identify areas where you’re overspending and make necessary adjustments to stay within your means.

Moreover, effective financial planning lets you set clear financial goals, such as buying a house, starting a business, or retiring comfortably. With proper budgeting techniques and charts provided by iCash software, you can monitor your progress toward these goals and make informed decisions.

While reducing expenses may initially seem challenging, reducing unnecessary costs becomes easier when adopting small lifestyle changes. From cooking at home instead of eating out frequently to canceling unused subscriptions or negotiating lower bills with service providers – every effort counts towards achieving greater savings.

Additionally, incorporating money-saving tips into everyday life further boosts savings potential. Whether it’s comparison shopping before making purchases or utilizing coupons/discounts whenever possible – these practices add up over time and contribute significantly to overall cost reduction.

Negotiating lower bills is another powerful strategy that many people overlook. Take the initiative to reach out to service providers such as insurance companies or internet/cable providers; inquire about discounts or promotions that could save you hundreds of dollars annually.

Exploring alternative ways to save money opens up new possibilities for optimizing your spending habits. Consider carpooling with colleagues instead of driving alone daily; brew coffee at home instead of grabbing expensive lattes at coffee shops; or explore DIY projects instead of hiring professionals for certain tasks.