What does ‘Personal finance’ actually mean?

Personal finance

Personal finance applies the principles of financial economics to an individual’s (or a family’s) financial decisions.

It asks, “How much money will you need at various points in the future?” and “How do you go about getting that money?”. It deals with questions like:

– What is my annual income? How can I increase my income?

– What are my annual expenses? How can I reduce my expenses?

– How do I best budget my available income each year?

– Most important, how much money can I save each year?

– And how much will I accumulate over my working lifetime?

– Will this be enough to support me after I retire?

– How much will it cost each year after I retire?

– And how many years will I be retired?

– How do I pay for large expenses (like children’s education or a house) when they arise?

– How can I reduce my financial risk? Through insurance? Through pensions?

– What do I do with the savings that I have accumulated?

– What is the best way of investing this capital?

– How much debt do I have? What are the monthly debt servicing payments?

– What is the value of my assets? And what effect will taxes have on these issues?

– How do I minimize the taxes I must pay? What effect will inflation have on these issues?

– How will these issues change as I go through the stages of my life?

A Question of Time

Personal finance is a detailed analysis of financial flows at various times. For example, we may receive employment income today, but have to pay college tuition fees next year.

Mortgage payments, interest earned, insurance premiums, and other financial flows are recurring monthly or yearly events.

Because these involve several time periods, we must ask “What role does time have in these financial calculations?”.

We know that if we deposit money in a bank account, we will receive interest. Because of this, we prefer to receive money today rather than in the future.

The money we receive today is more valuable to us than money received in the future by the amount of interest we can earn with the money. This is referred to as the time value of money. To adjust for this time value, we use two simple formulas.

The present value formula is used to discount future money streams. That is, to convert future amounts to their equivalent present-day amounts. The future value formula is used to convert today’s money into the equivalent amount at some time in the future.

All personal financial planning done by professionals uses these time value formulas, as well as several more complicated variants of the formulas. To ignore the role that time plays in financial planning is to ignore one of the most important principles of personal finance.

The financial planning process

The financial planning process is a dynamic process that requires regular monitoring and reevaluation. In general, it has five steps: assessing your situation, setting goals, crafting a plan, taking action, and monitoring your progress.

1. Assessing your financial situation

Assessing your financial situation is usually done by compiling several lists. These lists are simplified versions of corporate balance sheets and income statements.

On your personal balance sheet, you list all your assets (e.g., car, house, clothes, stocks, bank account) and give their values. You also list all your liabilities (e.g., credit card debt, bank loan, mortgage) and give their values.

Subtracting your total liabilities from your total assets will indicate your personal net worth. To understand how your personal net worth will change in the future, you compile what is called a personal cash flow statement.

This lists your income and your expenses. You obtain your net cash flow for the period by subtracting your expenses from your income. If your net cash flow is positive, your personal net worth will increase. Most people grossly underestimate how much they spend each year.

2. Setting goals

Setting goals gives your life a financial direction. Examples of financial goals are: “To retire at age 50 with a personal net worth of $800,000”, or “To buy a house in 3 years paying a monthly mortgage servicing cost that is no more than 25% of my gross income”.

Therefore, it is not uncommon to have several goals, some short-term, and some long-term.

3. The financial plan details

The financial plan details how you will accomplish your goals. It could include, for example, reducing unnecessary expenses, increasing your employment income, or investing in pork belly futures.

However you plan to do it, detailed calculations must be made for each period (usually yearly). The effects of taxation and inflation must be considered.

4. The best plan for your goals and circumstances

When you have decided on the best plan for your goals and circumstances, you implement it. This involves taking specific actions. It often requires discipline and perseverance. Many people obtain assistance from professionals such as accountants, financial planners, investment advisors, and lawyers.

5. Monitoring the progress

As time passes, it is important to monitor your progress. If it looks like you will not achieve your goal, you can alter your plan or adjust your goal.

The financial life-cycle

On our journey through life, we tend to go through stages. The stage we find ourselves in will impact our financial planning. Modigliani and Brumberg (1954) devised a model to explain these stages. Here is a simplified version:

1. Individuals supported by parents

– Income is very low

– Few financial decisions

2. Young single

– Income barely matches expenditures – no significant savings

– Financial decisions tend to be mostly short term

– Purchase a car, clothes, music systems

– Budgeting is important

3. A young couple, no children

– Income greater than expenditures – some savings

– Purchase home furnishings

– Purchase home

4. Couple (or individual) with children

– Income approximately equal to expenditures

– Upgrade house

– Purchase children’s toys, clothing, and supplies

– Purchase life insurance

– College tuition expenses

– Debt management is important

5. Empty nesters

– Income greater than expenditures

– Purchase investments

– Retirement planning is important

– Tax considerations are important

6. Retired

– Income less than expenditures

– Live off of savings

– Purchase medical and nursing services

– Estate planning is important

Note that these financial activities need not occur in the stages as described. In fact, it is beneficial to do many of them as early as you can. For instance, estate planning, investment planning, and retirement planning should all be done as soon as possible.

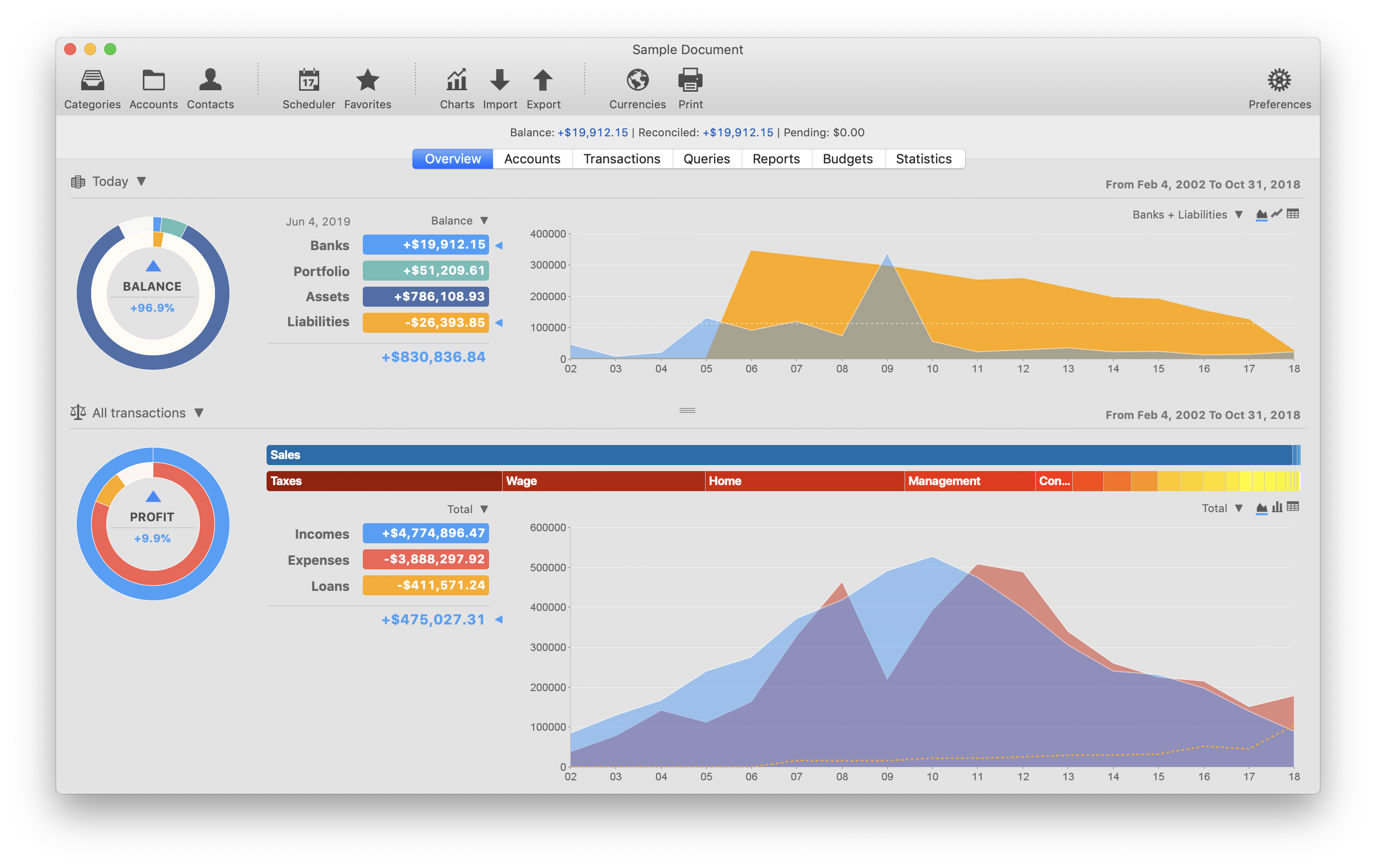

In conclusion, your finances depend largely on good organization that lets you know where your money comes from and where it goes. Therefore the first step in getting your finances under control is keeping records with the help of good personal finance software!

References

• Modigliani, F. and Bumberg, R. (1954) Utility analysis and the consumption function: An interpretation of cross-section data, Post Keynesian Economics, Rutgers University Press,1954.

• Kwok, H., Milevsky, M., and Robinson, C. (1994) Asset Allocation, Life Expectancy, and Shortfall, Financial Services Review, 1994, vol 3(2), pg. 109-126.

• Milevsky, M. and Robertson, C. (2000) Self-annihilation and ruin in retirement, North American Actuarial Journal, 2000, vol 4(4).

More information at Wikipedia

iCash is a personal finance software developer by maxprog.com.

[…] reading: – What is Personal Finance? – How to take advantage of Budgets in […]

[…] reading: – What is Personal Finance? – How to take advantage of Budgets in […]

[…] reading: – What is Personal Finance? – How to take advantage of Budgets in iCash – How to save money […]

[…] reading: – What is Personal Finance? – How to take advantage of Budgets in iCash – How to save money […]

[…] reading: – What is Personal Finance? – How to take advantage of Budgets in iCash – How to save money […]